Arizona FHA Loans Standards and you will Mortgage Restrictions getting 2022 Washington FHA Lenders

Washington homebuyers who require a small deposit or keeps bad credit scores might be able to get a house with an arizona FHA financing. There are various FHA loan providers in Arizona exactly who offer FHA money, but not them take part in the FHA financing solutions.

We’ll take you from Arizona FHA loan criteria, outline all it takes to meet the requirements, next help you get pre-licensed. For folks who already fully know one to an enthusiastic FHA financing is good getting your, then click for connecting that have an arizona FHA financial if your live in Phoenix, Flagstaff, Tucson, otherwise any place else.

The latest deposit conditions to have an enthusiastic FHA mortgage is similar in almost any state. Minimal significance of a keen FHA mortgage are step 3.5% of the cost. Yet not, if for example the credit rating is actually below 580, then down-payment requirements is 10%.

There are numerous down payment direction apps in any county. Lower than try a list of just a few down-payment direction apps which might be nowadays from inside the Arizona. Homebuyers will have to get in touch with, and you will plan for these software individually. Lenders will accept the income from the applications to suit your down payment nonetheless they does not plan for the downpayment recommendations.

Washington FHA Mortgage Criteria getting 2022

They are the basic FHA mortgage conditions because of it season. All of these should be satisfied as approved to own a keen FHA financing. If you aren’t self-confident towards the if or not your see this type of conditions otherwise features concerns, an enthusiastic FHA lender may help.

- Deposit regarding 3.5% or ten% should your credit score was below 580

- 2-12 months a job history with many conditions desired

- Totally file your income over the past a couple of years

- Minimal FICO get element five hundred down-payment will vary

- Financial Advanced (MIP) will become necessary for each FHA mortgage

- Restrict obligations so you can money proportion away from 43% which have conditions to 56%

- Our home must be most of your residence

- Zero bankruptcies or foreclosures in past times a couple of years

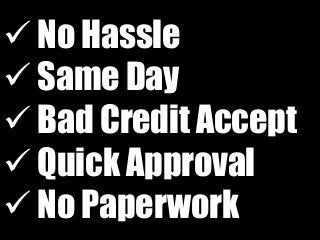

Washington FHA Loan Professionals

- Straight down credit scores permitted

Ideal Washington FHA loan providers

These firms are merely a few options for you to think. Take note that every lender differs and it is you’ll that nothing of those choices are best for you dependant on your circumstances.

Let us enable you to find a very good Arizona FHA lenders in your area by completing that it FHA financing circumstance setting that have some elementary financing circumstances recommendations. No credit history might possibly be taken so we is connect you to the best choice.

Arizona FHA Loan Constraints

The condition in the usa has actually particular limitation loan restrictions which might be set for single family unit members residential property, as well as 2-cuatro unit characteristics. The fresh new constraints are ready based upon the common domestic sales value where state. The bottom FHA mortgage limitation getting solitary family members homes during the Washington for some counties was $420,680. Make use of this FHA mortgage restrict look unit to see just what FHA mortgage constraints can be found in your own condition.

FHA 203k Loans in the Arizona

FHA 203k funds are a great program that may assist you in order to borrow the money must purchase the household in addition to extra money wanted to rehabilitate or upgrade the house. This choice is https://paydayloancolorado.net/capulin/ even found in your state so we work having loan providers that assist together with your FHA 203k financing.

If you want to totally recognize how this program work, we suggest training our very own breakdown of FHA 203k fund .

FHA Streamline Refinance when you look at the Arizona

This new FHA improve refinance program can be found to help you established people just who would like to refinance to possess a reduced rates when you find yourself removing certain of the re-finance costs eg an appraisal. You’ll be able to rating a benefit with the home loan advanced that is another advantage.

Washington FHA Mortgage Pre-Approval Techniques

Speak to a lender at the beginning of the method as they possibly can select opportunities to assistance with your own FHA acceptance. This should be done weeks before you start looking a beneficial household. Find out more on how to rating pre-acknowledged to own a keen FHA mortgage .

What to Look out for in a keen FHA Bank

We bring a couple of things into consideration when looking at and that loan providers we work on. These and are, or can be necessary for you as you continue searching getting an enthusiastic FHA mortgage.