If you are intending towards strengthening an alternate house, you can utilize Region’s One-Time-Closing Framework-to-Long lasting Program to aid finance the development costs. Places is transfer a housing mortgage toward a permanent financing whenever the development is finished, giving you only 1 group of closing costs plus one financing.

Repair Financing

Regions’ Re assists property owners pay the costs and make home improvements and you may high fixes to their house. For example their design fund, the repair fund just have you to closure commission plus one financing.

Household Reasonable Re-finance Program (HARP)

New FHA created this type of mortgage refinance choice in 2009 to greatly help residents with Fannie mae otherwise Freddie Mac computer-recognized loans out-of prior to for borrowers with little to no guarantee in their domestic otherwise who owe more than their house deserves. Regions therefore the FHA encourage property owners so you’re able to refinance their residence that have a less expensive mortgage.

Regions Lender Mortgage Buyers Sense

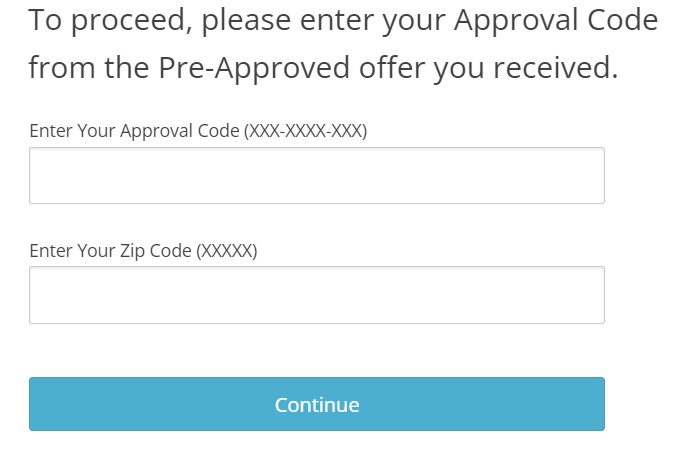

To begin with, there clearly was an online application form users normally fill in in the event that they had like to go without cellular phone conversations. Users can also carry out an account so that they can begin a keen software and you can resume they at another time. If you want to communicate with a support personal to help you ask for a mortgage but do not need to waiting on the keep, you could fill out an on-line mode so they are able get in touch with your at the same time that is simpler for your requirements.

Countries Lender also provides other helpful tips on the internet to greatly help prospective borrowers comprehend the financial process. The mortgage calculator makes it possible how to open a bank account with no deposit to determine how much domestic you are able to afford and you may imagine the price of your home loan. It also provides a home Customers Heart, that has stuff that take you step-by-step through for each and every stage out of refinancing and you may taking out fully a home loan, in addition to delivering most other practical advice for homebuyers.

Regions rated last place on new 2017 J.D. Strength First Financial Maker analysis, about Guild Mortgage lender, Quicken Loans, and you will Primary Financing. Yet not, Regions ranked third within the 2016, after the Quicken Money and you can Huntington National Lender. During the both age, it was ranked much better than most. The fresh score improved .

Although not, an individual Economic Agency Month-to-month Grievance Declaration integrated Regions Monetary in the top 10 a number of very-complained on the organizations in the condition away from Tennessee. As seventh really reported-regarding financial within this state, it looks most problems came from Regions’ banking functions, with just some says arising from its financial circumstances.

Countries Financial Financial Character

Regions Bank is a public economic services company that has been offering sixteen claims about U.S. for just bashful away from half a century. Places Economic Agency Federal Home loan Certification Human body’s (NMLS) count was 174490.

Recommendations for it financial try apparently combined. LendingTree includes a beneficial 5/top get for Nations Lender. But not, regardless if Places keeps a the+ score into the Better business bureau, it’s got the average rating from only 1 superstar, having 556 complaints submitted in the last three years.

Regions Lender faced its great amount from scandals before while. In 2011, Nations needed to pay a good $200 mil settlement towards You.S. Securities and you can Change Payment. They stemmed out-of Regions’ mistaken cost to your large-risk financial securities as part of the bank’s Morgan Keegan part.

Within the 2015, the newest CFPB fined Nations $eight.5 billion immediately following they recharged users illegal and inaccurate overdraft fees, as opposed to inquiring the users to willingly choose to your overdraft costs during the economic purchases. That’s not it: Regions has also been trapped misrepresenting not enough fund fees in small-term financing team.

Even after this type of controversies, Nations Economic Organization has received 1000s of honors and you may identification over the age. On the fifth season consecutively, Countries possess rated regarding top ten % off enterprises noted in the Temkin Sense Critiques. Greenwich Couples including awarded Countries having 23 Excellence awards and you will around three Most useful Brand name honours inside 2017. To your 2nd consecutive year, Places claimed Javelin’s Have confidence in Financial Chief Award thus of one’s bank’s faith and you can support to their customers.